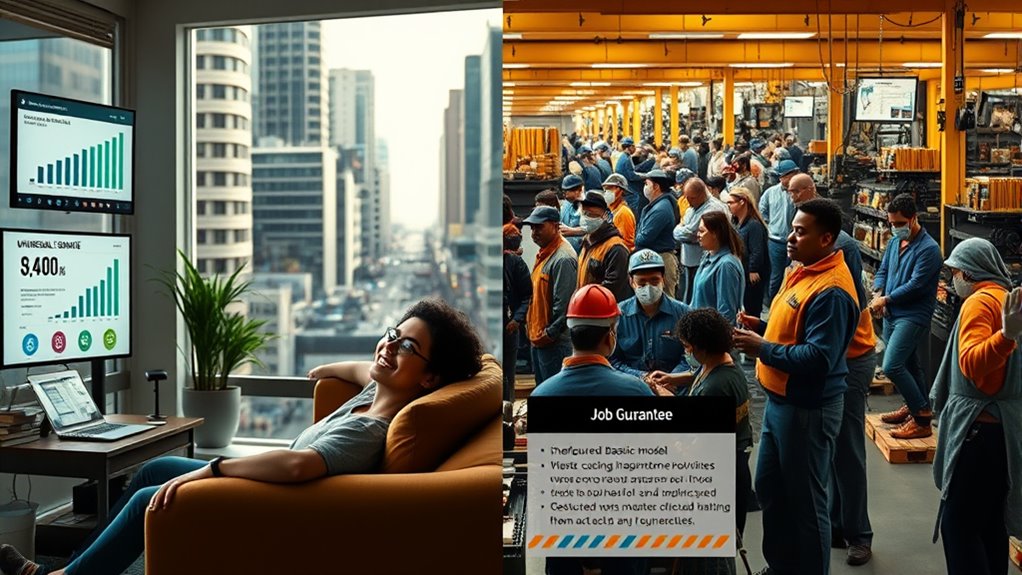

If you’re wondering which approach better secures the future of work, consider that Universal Basic Income provides quick, unconditional cash support, helping reduce poverty and boost economic resilience, while Job Guarantees link income to meaningful employment with benefits, fostering dignity and skills. Both aim to promote social justice but operate differently. Exploring these strategies further reveals how each could shape a more inclusive, stable economy well into the future.

Key Takeaways

- UBI offers rapid income security and poverty reduction, providing a universal safety net adaptable to future economic shifts.

- Job guarantees promote long-term employment stability and skill development, fostering resilience amid technological and economic changes.

- UBI simplifies administrative processes, enabling quicker implementation, while job guarantees require complex program infrastructure.

- Job guarantees embed social inclusion through work-based benefits, supporting community engagement and dignity in the evolving job market.

- Both policies contribute to securing the future of work, but combining them may offer comprehensive economic stability and social justice.

Defining the Core Concepts: UBI and Job Guarantee

To understand the core concepts of UBI and job guarantees, recognizing how each policy aims to address economic security through different mechanisms is vital. UBI is a government program that provides every adult citizen a fixed cash payment regularly, with no conditions or work requirements. It’s universal, meaning everyone receives it regardless of income or employment status, and the payments are unconditional and long-term. UBI simplifies social support by replacing or supplementing need-based programs, giving individuals direct financial stability. In contrast, a Job Guarantee ensures that anyone willing and able to work can obtain a government-funded job. It offers employment in public or community projects at socially inclusive wages, aiming to promote full employment and social contribution. Both policies seek economic security but operate through fundamentally different approaches: cash transfers versus guaranteed work. Research indicates that job guarantees can help reduce poverty and economic insecurity while promoting social cohesion. Additionally, administrative complexity varies between the two, with UBI typically requiring streamlined distribution systems and job guarantees necessitating infrastructure for employment programs. Furthermore, cost considerations are crucial in evaluating the feasibility and long-term sustainability of each approach. Incorporating technology-enabled solutions, such as AI management systems, could further enhance the efficiency and effectiveness of implementing these policies.

Economic Impact and Poverty Reduction Strategies

You can see that UBI offers faster poverty alleviation by providing immediate income support, while a job guarantee ensures income security through stable employment. UBI’s simplicity makes it easier to implement quickly, but job guarantees foster long-term economic stability through skills development. Both strategies impact income security levels differently, shaping their effectiveness in reducing poverty. Additionally, sound recording techniques can be utilized in creating educational content that discusses these economic strategies, broadening public understanding. For example, incorporating preppy dog names into educational narratives can make complex topics more engaging and relatable.

Poverty Alleviation Speed

When it comes to quickly reducing poverty, the choice between Universal Basic Income (UBI) and job guarantee programs hinges on their differing speeds and mechanisms. UBI can be implemented faster because it doesn’t require creating new jobs; it simply provides cash to everyone, which can immediately improve living standards. This rapid deployment helps reduce poverty broadly and boosts local economies through increased spending. In contrast, job guarantees take longer to set up, as they involve developing programs, infrastructure, and employment opportunities. While they directly target unemployment, the process is more complex and resource-intensive, delaying their impact. Additionally, understanding the patterns in recurring numbers can help policymakers better gauge the timing and effectiveness of these strategies. Implementing these programs requires careful planning and resource allocation, which can influence their overall success. accordingly, if swift poverty alleviation is the goal, UBI offers a quicker solution, providing immediate support and economic stimulus. Notably, high critical acclaim for certain initiatives underscores the potential effectiveness of rapid implementation strategies.

Income Security Levels

Income security levels substantially influence both economic stability and poverty reduction strategies. With UBI, you get a steady cash flow that boosts consumer spending, stimulates demand, and supports small businesses. Studies suggest a modest UBI could increase GDP markedly, especially by encouraging entrepreneurship and local economic growth. However, UBI can be costly and may lose value if not adjusted for inflation, potentially undermining its effectiveness. On the other hand, a Job Guarantee provides income through employment, ensuring people work at a living wage. This approach stabilizes the economy by expanding during downturns and contracting during booms, reducing reliance on unstable jobs. It directly addresses poverty by offering meaningful work, promoting social inclusion, and closing unemployment gaps, making income security more sustainable and equitable. A Job Guarantee also helps to reduce income inequality by providing stable employment opportunities for marginalized groups. Additionally, the economic impact of a Job Guarantee can be more flexible and adaptable to changing market conditions, ensuring long-term resilience. Furthermore, implementing a diverse range of employment opportunities can enhance social cohesion and community development, contributing to a more resilient economic framework. Incorporating alternative investments like Gold IRA as part of a broader financial strategy may also help safeguard assets against economic fluctuations.

Wage Structures and Benefits: Comparing the Models

You need to contemplate how UBI offers a consistent baseline income, reducing wage disparities and providing financial security regardless of employment status. In contrast, job guarantee programs tie wages directly to specific roles, often with less focus on overall income equality. Both models influence benefits and employer support differently, shaping workers’ economic stability and job prospects. UBI is designed to be unconditional and universal, ensuring that all residents receive support without means-testing or work requirements. Additionally, water park amenities in hotels highlight how varied benefits can enhance overall quality of life and guest satisfaction. Recognizing the importance of Gold IRA and secure investment options underscores how essential financial planning and diversification are in safeguarding future stability.

Wage Levels and Security

Wage levels and security differ markedly between Universal Basic Income (UBI) and job guarantee models, shaping how financial stability is provided. UBI offers a fixed, unconditional payment—around $10,000 yearly—that’s the same regardless of employment or income, providing consistent support but not a wage for work. In contrast, the job guarantee sets a minimum wage, typically above poverty levels, with average wages around $32,500 or more, directly tied to employment. UBI reduces poverty broadly but doesn’t guarantee a specific income threshold or work-based security. The job guarantee ensures income security through guaranteed employment at a living wage, preventing “working poor” status. While UBI offers flexibility and independence, the job guarantee provides a more targeted safety net tied to labor participation. A guaranteed wage acts as a wage floor, incentivizing private employers to offer competitive wages and benefits. Additionally, the concept of labor market stability is central to understanding how these models influence overall economic resilience and worker well-being. Moreover, the stability of the wage structure can impact long-term economic growth and worker morale. Implementing strong social safety nets can further enhance economic security and reduce inequality over time, creating a more resilient and equitable economic environment.

Benefits and Employer Support

When comparing Universal Basic Income (UBI) and job guarantee models, differences in benefits provision and employer support stand out. UBE offers employer-provided medical coverage, retirement plans, and paid leave, creating a consistent benefits package across workers. It fosters a closer employer-employee relationship, with employers responsible for benefits, which can boost job satisfaction and workplace stability. UBE also provides an autonomous wage, encouraging private sector investment and allowing workers to earn more than safety net support. Training and development are often part of employment, promoting skill growth. In contrast, UBI doesn’t include benefits directly but increases spending flexibility and supports economic stability through a universal cash transfer. Both models reduce poverty and support community engagement, but UBE emphasizes employment-linked benefits and employer involvement.

Practicality and Implementation Challenges

Implementing Universal Basic Income (UBI) faces significant practical hurdles that can hinder its effectiveness and sustainability. The “benefits cliff effect” is a major obstacle, risking disqualification from social programs like SSDI, SSI, and SNAP, which can devastate families reliant on targeted aid. Shifting from existing assistance programs to UBI is complex and risky, due to strict eligibility criteria and administrative challenges. Scaling UBI beyond pilot phases proves difficult because of the need for extensive infrastructure and coordination with current systems. Funding UBI is costly, often requiring tax hikes or reallocations, which face political resistance. Additionally, ensuring equitable access, preventing fraud, and integrating UBI into existing safety nets demand robust systems, making widespread implementation a formidable task.

Social Benefits and Community Engagement

Universal Basic Income (UBI) offers numerous social benefits that can strengthen communities and improve individual well-being. It helps reduce poverty by providing a safety net, so you can meet basic needs without constant financial stress. With more financial security, stress levels drop, and mental health improves. UBI also encourages participation in community activities, fostering stronger social connections. It can lead to healthier behaviors and better overall health outcomes. Additionally, UBI grants you more freedom to pursue meaningful activities beyond just earning a paycheck.

- Supports community involvement and voluntary participation.

- Fosters innovative contributions from motivated individuals.

- Enables community development projects like shared resources.

- Enhances social well-being through fulfilling engagement.

- Builds prosperous, healthier communities by addressing social gaps.

Addressing Inequality and Social Justice Goals

Job Guarantee (JG) programs directly promote social justice and economic participation by ensuring that everyone has access to meaningful employment with fair wages and benefits. By providing wages above the poverty line, JG quickly reduces poverty and helps the working poor maintain financial stability. It explicitly ties income to work, supporting dignity and self-sufficiency, unlike UBI, which offers unconditional payments that may fall short of lifting all recipients out of poverty. JG also includes employment benefits like health insurance and pensions, broadening social security. It actively targets systemic barriers faced by marginalized communities, integrating them into the formal economy. In contrast, UBI’s flat payments risk benefiting wealthier individuals and may not address deeper inequalities rooted in race, gender, or geography.

Potential Effects on Workforce Motivation and Skills

Universal Basic Income (UBI) can considerably influence workforce motivation by providing financial security that reduces the need to accept undesirable jobs. This stability allows you to pursue careers aligned with your interests and intrinsic motivations. It also gives you the freedom to leave poor working conditions, encouraging better workplaces overall. UBI can lead to higher job satisfaction and more diverse career choices, fostering personal fulfillment. Additionally, with a safety net, you might invest more time in education, skills training, and entrepreneurship. However, you may find less external motivation to take low-paying or routine jobs, potentially impacting workforce engagement. Overall, UBI shifts motivation towards meaningful work and skill development, shaping a more motivated and adaptable workforce.

Evaluating Long-term Sustainability and Future Readiness

Evaluating the long-term sustainability and future readiness of UBI versus job guarantee programs requires examining their economic and environmental impacts over time. UBI could markedly boost global GDP—up to 130 percent—by increasing participation and consumption, and modeling suggests it’s fiscally sustainable if well-designed. It also enhances community resilience during crises, reducing recovery costs. However, funding remains a concern, needing innovative mechanisms like environmental taxes. Environmentally, UBI may increase resource use but can promote sustainable consumption and support eco-friendly goods. Conversely, job guarantees, especially in green sectors, embed sustainability directly into employment. Both policies’ longevity depends on integration with broader ecological strategies. Ultimately, UBI offers widespread social benefits and economic growth potential, but both approaches must prioritize ecological and fiscal stability for future readiness.

Frequently Asked Questions

How Do UBI and JG Impact Labor Market Participation Differently?

You see that UBI and JG influence labor participation differently. UBI makes work more voluntary, so you might choose to work fewer hours or leave low-quality jobs, reducing overall labor supply. In contrast, JG guarantees you a job with benefits, encouraging you to stay engaged and work more consistently. While UBI offers flexibility, JG promotes steady employment and better work conditions, shaping your involvement in the labor market distinctly.

What Are the Fiscal Implications of Implementing UBI Versus JG Nationwide?

You might find it surprising that funding a nationwide UBI of $1,000 monthly per adult could require doubling current tax revenues, raising concerns about fiscal sustainability. Implementing UBI involves high costs, mainly from broad coverage and increased taxes. Conversely, a Job Guarantee program’s costs depend on wages and scale but can stimulate economic activity and reduce welfare spending, potentially balancing fiscal impacts over time. Both options profoundly influence government budgets and economic stability.

Can UBI or JG Effectively Address Automation-Driven Job Displacement?

You wonder if policies like UBI or a Job Guarantee can tackle automation-driven job displacement. UBI provides financial support, helping you stay afloat while seeking new opportunities. A Job Guarantee offers stable employment, keeping your skills sharp and preventing long-term unemployment. Both approaches have strengths, but combining them might be most effective, ensuring you’re protected financially and professionally as automation continues to reshape the job market.

How Do UBI and JG Influence Economic Inequality Beyond Poverty Reduction?

You see, both UBI and JG can reduce economic inequality beyond just lifting people out of poverty. UBI spreads wealth more evenly by providing cash directly, especially helping marginalized groups, and gives you more financial independence. JG raises wages for low earners and creates job opportunities, which can narrow income gaps. Both strategies empower you to build a more equitable economy, fostering long-term social mobility and reducing disparities.

Which Model Better Supports Long-Term Economic Resilience and Adaptability?

Imagine a future where your job security and adaptability are truly protected. You might think one approach guarantees this better—yet the real answer lies in understanding which model fosters resilience. A Job Guarantee keeps skills sharp and offers stable employment, while UBI provides financial freedom to innovate and adapt. Ultimately, the best choice empowers you to navigate change confidently, ensuring long-term strength in an unpredictable economy.

Conclusion

So, whether it’s a guaranteed paycheck or a universal safety net, one thing’s clear: your future’s secure—unless, of course, you’re dreaming of a world where everyone’s just waiting for handouts. Imagine a society where work is optional, and laziness is celebrated as progress. In this brave new world, you might as well hang up your ambition and polish your lounge chair—because with these ideas, the future of work might just become a never-ending vacation.