Beyond wages, value is increasingly created through intangible assets like innovation, brand reputation, and organizational knowledge. Automation and AI enable passive income streams, reducing reliance on traditional labor. External contributions such as community engagement and ESG practices also build long-term value. With technological advances and shifting economic models, wealth can grow without humans working in the usual sense. To explore how these shifts reshape value creation, there’s more to uncover.

Key Takeaways

- Value is increasingly generated through intangible assets like innovation, intellectual capital, and automation, reducing reliance on human labor.

- Automation and AI enable passive income streams, creating wealth without direct human work.

- Sustainable products and eco-friendly materials appeal to conscious markets, adding value beyond manual labor.

- External contributions such as community engagement and ethical practices enhance brand reputation and stakeholder trust.

- Long-term value creation now emphasizes knowledge, technology, and environmental impact, transcending traditional wage-based contributions.

Broadening the Scope of Value Creation Beyond Employee Wages

While paying employees wages is essential, it’s increasingly important to recognize that value creation extends far beyond compensation. Non-monetary investments play a crucial role in building long-term organizational success. Engaging employees through recognition programs, professional development, and wellness initiatives boosts productivity and retention. Emphasizing diversity, equity, and inclusion enhances organizational performance, though effects vary by context. Supporting employee health and safety fosters loyalty and sustained value. Beyond internal efforts, satisfying customer needs and maintaining ethical supplier relationships strengthen brand reputation. Community engagement and ESG practices attract investors and customers, creating broader stakeholder value. Recognizing that workforce expectations evolve—especially among Gen Z—means adapting recognition strategies and growth opportunities. Research indicates that companies prioritizing long-term stakeholder interests tend to outperform their peers over time. This holistic approach ensures your organization remains competitive and resilient in the long run, especially when incorporating vibrational alignment principles to foster a positive work environment.

The Impact and Importance of Living Wages in Modern Economies

Living wages play a crucial role in shaping modern economies by ensuring workers earn enough to meet basic needs without relying on social assistance. When workers receive a living wage, poverty decreases, and wage inequality narrows, boosting bargaining power. You’ll see fewer families depending on food assistance, as higher wages reduce reliance on social services. Studies also reveal that wage increases don’t necessarily cause job losses; instead, they can improve employment and income levels. Moreover, increased wages stimulate local economies through higher consumer spending. Additionally, understanding the significance of Relationships – Personality Test can help foster better workplace and community connections, further amplifying the positive effects of fair wages.

Wage setting is a dynamic process where employers and employees negotiate to determine compensation, influenced by various institutional frameworks such as unions, collective bargaining agreements, and minimum wage laws. You’re likely aware that market forces like supply and demand, along with skills and experience, also shape wages. Governments often set a wage floor through minimum wage laws, ensuring basic income levels. This process can happen at different levels—from individual negotiations to national policies—each with varying degrees of centralization. The way economic value is shared involves distributing wages, benefits, taxes, and investor returns. Factors like technological change, globalization, and institutional rules influence how wages are allocated across sectors and workers. This complex system determines who benefits from the wealth created in modern economies. Understanding data distribution can help policymakers analyze wage disparities and design more equitable economic systems, especially when considering wage setting mechanisms and their impact on income distribution.

The Disconnect Between Wage Growth and Productivity Gains

Since the 1970s, the relationship between worker compensation and productivity growth has markedly weakened, leading to a notable disconnect. You’ll notice that, despite business output per hour increasing by roughly 2% annually since 1970, wages for the median worker have stagnated. This gap is part of a broader “great decoupling” observed across 24 OECD countries, where wage growth trails behind productivity gains. The effects include income concentration at the top and slower overall economic growth. Additionally, the rise of Gold IRA Rollovers reflects a growing trend among investors seeking to hedge against economic uncertainties and inflation that may impact traditional wages and savings.

Policy Influences on Wage Suppression and Economic Inequality

Government policies play a crucial role in shaping wage levels and economic inequality, often reinforcing disparities rather than alleviating them. When transfer programs are cut, lower-income households become more vulnerable, and wage growth stalls for the bottom 50%. The lack of real wage increases over two decades reflects policy failures to support earnings for middle and low-income workers. Meanwhile, the top 10% benefit mainly from gains in business and asset income, widening income gaps. The federal minimum wage remains stagnant at $7.25, leaving many workers in poverty, despite proposals to raise it to $15. By weakening unions and favoring corporate tax cuts, policies further suppress wages and favor capital over labor. These choices deepen inequality, making economic disparities harder to bridge. Vetted policies and colorful salary structures can influence how wages are distributed and perceived across different sectors.

New Pathways for Generating Wealth Without Traditional Labor

Automation and AI are transforming how wealth is generated, enabling you to earn passively with minimal human input. By leveraging capital and intellectual assets, you can create sustainable income streams that don’t rely on traditional work. This shift opens new opportunities to build wealth through innovative, automated, and scalable methods. Passive income streams such as online courses, digital products, and automated investing platforms are becoming increasingly accessible, allowing individuals to diversify their income sources without extensive ongoing effort. Understanding affiliate marketing disclosures can help ensure transparency and compliance when promoting these income streams.

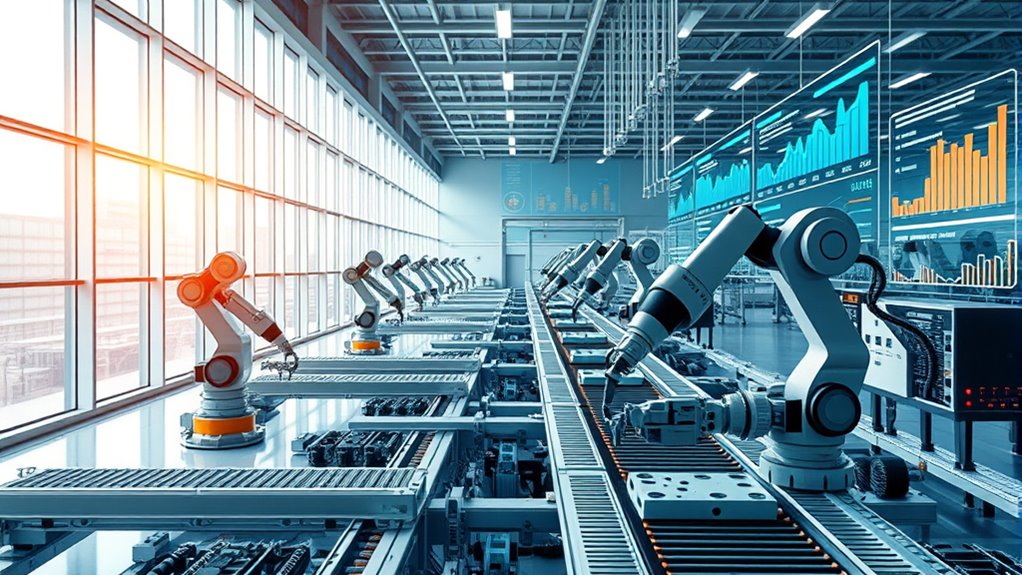

Automation and AI Impact

Automation and AI are transforming how wealth is generated by enabling new pathways that don’t rely on traditional human labor. You can now leverage AI to automate repetitive tasks, reducing the need for human intervention in sectors like manufacturing and logistics. AI-powered tools, such as chatbots and robotic process automation, allow businesses to scale with minimal additional labor costs. Additionally, passive income streams emerge from AI-driven trading algorithms, niche platforms, and automated e-commerce, generating wealth with little ongoing effort. Incorporating natural materials like wood and linen in business models can also create authentic and sustainable products that appeal to eco-conscious consumers.

Capital and Intellectual Assets

As the economy shifts toward knowledge-based assets, intellectual capital has become a primary driver of wealth creation beyond traditional labor. Its value in the U.S. grew from about $5.5 trillion in 2005 to $9.2 trillion in 2011, representing over half of GDP. Intangible assets, including employee skills and organizational knowledge, now surpass physical assets in importance. Firms increasingly allocate resources to these assets, reflecting a structural move toward innovation-driven growth. Measuring this capital involves investments in human, structural, and relational components, all of which boost firm value. Research shows that stronger intellectual capital enhances innovation, industry growth, and financial performance. By optimizing these assets, you can generate wealth without relying solely on traditional labor, shifting the foundation of economic value. The measurement of intellectual capital can be complex but is crucial for understanding how these intangible assets contribute to overall economic growth.

Frequently Asked Questions

How Do Intangible Assets Contribute to Value Creation Beyond Wages?

Intangible assets boost value creation by enhancing productivity, innovation, and competitive advantage beyond wages. When you invest in software, data, brands, or organizational capital, you create scalable assets that generate income without directly increasing labor costs. These assets help your business adapt faster, improve efficiency, and capture new markets, ultimately driving long-term growth and increasing overall market value, even when human labor remains constant.

Can Automation Fully Replace Human Labor in Future Economic Models?

You might think automation’s march will sweep away all human labor, like a tidal wave drowning shores. But, in reality, it won’t fully replace human work. Complex judgment, emotional nuance, and creativity are like fire—hard to tame with gears and code. So, while automation transforms many roles, it leaves a essential space for human touch, making future economies more about synergy than outright replacement.

What Role Do Global Supply Chains Play in Wage Distribution?

Global supply chains considerably influence wage distribution by raising wages for participating firms, especially in developing countries. You’ll notice higher pay in export-oriented industries, but this often benefits skilled workers more, increasing wage inequality. As supply chains grow, regions with advanced technology exert downward pressure on wages elsewhere. Your role in these chains can impact wage gaps, with skilled workers gaining more, while others see limited or uneven wage growth.

How Do Social Programs Influence Overall Economic Value?

You see, social programs boost overall economic value by supporting consumer spending, especially during downturns. They act as automatic stabilizers, increasing benefits when jobs decline, which keeps demand steady. This ongoing support helps businesses stay afloat, preserves jobs, and stimulates economic activity through the multiplier effect. When you receive assistance, you maintain purchasing power, which benefits the entire economy by encouraging production, consumption, and growth—even when you’re not working.

Are Universal Basic Income Schemes Effective in Sharing Wealth?

Universal Basic Income schemes are effective in sharing wealth because they provide a safety net for everyone, reducing poverty and economic inequality. You see, by offering unconditional financial support, UBI ensures that even the most vulnerable can access basic needs, promoting social stability. It also empowers individuals to pursue education, start businesses, or care for families, which benefits society as a whole. So, UBI helps distribute wealth more fairly across communities.

Conclusion

Just as the phoenix rises from its ashes, true value can emerge beyond wages when we rethink how wealth is created. By embracing innovative pathways and addressing the gaps between productivity and pay, you can help forge a more equitable economy. Remember, like Icarus reaching for the sun, aiming higher isn’t without risks, but it’s essential for *unleashing* new sources of wealth—especially when humans aren’t working in the traditional sense.