Many believe UBI is too expensive, but that view relies on narrow cost estimates and outdated ideas. When you consider alternative funding options like progressive taxes, and efficiency improvements in program delivery, it becomes more feasible. Regional differences and economic effects also matter, showing that affordability isn’t a simple budget number. If you explore these factors further, you’ll see that the true challenge might be how we think about funding and implementation.

Key Takeaways

- Cost estimates often omit alternative funding sources like wealth or carbon taxes, which could make UBI more affordable.

- Administrative efficiencies and technological innovations can significantly reduce UBI program costs.

- Reassessing assumptions about work disincentives shows potential for economic growth and long-term fiscal benefits.

- Regional cost variations suggest tailored UBI approaches could improve affordability and effectiveness.

- Broader strategic reforms and integrated safety nets may lower overall expenses, challenging the perception of UBI’s unfeasibility.

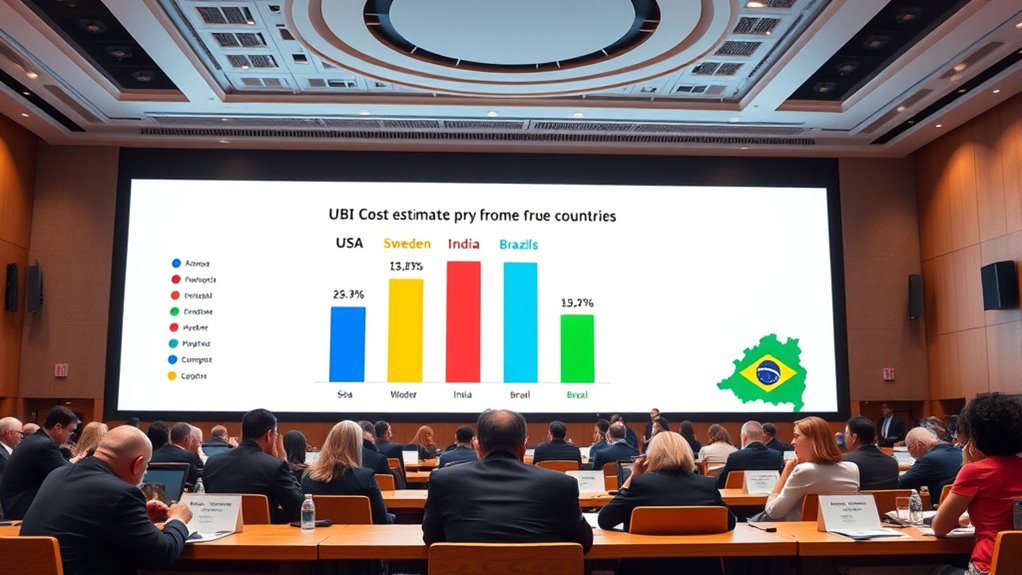

Examining the Cost Estimates Across Countries

When comparing the cost estimates for implementing a universal basic income across different countries, it becomes clear that expenses vary widely depending on economic conditions and social welfare systems. In the US, providing $12,000 annually per adult would cost around $3 trillion each year. The UK’s estimates range from £67 billion to £427 billion, depending on support levels for a livable wage. Switzerland’s projected cost is about 208 billion francs annually, which could partly be covered by abolishing existing social programs. Microsimulation studies, like those based on the UK’s 2019/2020 data, suggest costs depend on specific UBI levels and tax rates. Overall, each country’s economic and social context considerably influences the affordability of UBI. Cost estimates can also be affected by potential economic growth and increased employment resulting from UBI policies. Additionally, understanding the economic impact of UBI is essential for assessing its long-term feasibility and sustainability, especially considering the funding mechanisms that could support such programs. Furthermore, the Gold IRA investment model demonstrates how diversifying assets can help preserve wealth during economic fluctuations, which is an important consideration when evaluating long-term fiscal commitments such as UBI. Recognizing the influence of economic growth can help policymakers better estimate future funding needs for UBI initiatives.

Funding Challenges and Potential Solutions

Implementing UBI faces significant funding challenges, especially regarding how it integrates with existing public assistance programs. You risk triggering the “benefits cliff effect,” where recipients lose essential benefits like SSDI, SSI, SNAP, or Medicaid, undermining financial stability. Different eligibility rules across programs make it hard to coordinate UBI with current benefits, reducing support for low-income families. To address this, a unified public assistance system with consistent rules is essential. Funding UBI typically requires substantial tax hikes, such as increasing income tax rates or removing personal allowances, but these can still leave gaps—like a £28 billion shortfall. Diversifying revenue sources, including wealth or carbon taxes, can help. Streamlining administration through federal reforms reduces costs and improves efficiency, making UBI more sustainable and politically feasible. Complex eligibility criteria and administrative hurdles also hinder efficient funding and implementation of these programs. Additionally, establishing a more integrated social safety net is crucial to ensure that benefits are aligned and accessible across different support systems. Developing cost-effective delivery mechanisms can further enhance program efficiency and public support. Addressing funding sustainability by exploring innovative financing options is vital for the long-term success of UBI, especially as funding mechanisms evolve to meet economic needs, and understanding the role of administrative costs is key to optimizing resource allocation.

Economic Effects of Implementing UBI

Introducing UBI can markedly influence labor supply and work incentives, primarily through a pure income effect that encourages you to work less since your basic needs are guaranteed. This effect can lead to a decrease in overall labor hours and participation rates, especially among marginal workers. Here’s what you should consider:

- Higher taxes needed to fund UBI can lower your incentives to work, as they reduce your take-home pay and raise marginal tax rates.

- Reduced labor supply may lead to less on-the-job learning and lower overall work engagement, impacting human capital development.

- Despite some decline in labor, models suggest that UBI could increase formal sector participation, potentially improving labor market dynamics over time.

These effects highlight complex trade-offs between income security and economic productivity when implementing UBI. The impact on labor supply underscores the importance of carefully designing UBI policies to balance welfare improvements with maintaining economic vitality.

Variations in Expenses and Regional Impacts

Regional differences in expenses substantially influence how UBI functions across various areas. You’ll notice that housing costs vary greatly—London’s benefits reach £152, while Yorkshire’s are only £79. Food prices also differ, affecting how much UBI supports your needs. Local taxes, like council tax, further impact affordability and implementation. To illustrate:

| Region | Housing Benefit (£) | Average Food Cost (£) | Local Taxes (£) |

|---|---|---|---|

| London | 152 | 200 | 150 |

| Yorkshire | 79 | 180 | 100 |

| Midlands | 100 | 190 | 120 |

These variations mean UBI’s impact depends on regional costs, requiring tailored adjustments to maximize benefits and address local needs effectively. Accurate regional data is essential to ensure that adjustments reflect real living expenses and provide fair support across different areas. Additionally, understanding regional economic disparities can help policymakers create more equitable and effective UBI programs. Recognizing the cost of living differences is crucial for designing adaptive and sustainable support systems. Moreover, regional financial challenges can influence how UBI is funded and sustained over time, emphasizing the importance of targeted policy planning. Furthermore, considering local infrastructure and access to services can further refine how UBI is implemented to meet diverse regional needs. Understanding AI’s role in economic analysis can also improve the accuracy of regional assessments and policy responses.

Rethinking the Assumptions Behind UBI Affordability

Reevaluating the assumptions behind UBI’s affordability is essential to understand whether it’s a viable policy option. First, consider that funding a $12,000 annual UBI for all adults would cost around $3 trillion, about 75% of current federal spending. You might think this is impossible, but options like taxing income above a threshold could help fund it. Second, consolidating welfare programs into UBI could cut administration costs, making the system more efficient. Third, UBI could serve as an economic stimulus, boosting consumption and growth. By questioning these assumptions—such as the true cost, potential funding methods, and administrative savings—you can see that the affordability debate may overlook strategic reforms and the broader economic benefits UBI offers. The feasibility of funding UBI through progressive taxation strategies also challenges the notion that it is inherently unaffordable. Additionally, examining the potential for cost-saving innovations in program delivery highlights opportunities for efficiency that could further improve affordability. Moreover, understanding the administrative efficiencies gained from streamlined systems can make UBI more achievable.

Frequently Asked Questions

How Can UBI Be Financed Without Overly Taxing the Economy?

You can finance UBI without overtaxing the economy by using a mix of strategies. Increase taxes on high incomes, wealth, and digital services, while redirecting existing welfare and subsidy funds. Implement payroll taxes carefully to balance revenue and labor effects, and consider borrowing or reallocating budget surpluses temporarily. Combining these approaches spreads the fiscal load, supports UBI sustainably, and minimizes the risk of excessive economic strain.

What Are Alternative Funding Models Beyond Taxes?

You’re wondering about alternative UBI funding models beyond taxes—how clever of you! It’s ironic, isn’t it? We often overlook ideas like consolidating welfare programs, implementing wealth or environmental levies, or taxing automation and financial transactions. These methods could fund UBI without burdening workers or over-relying on traditional taxes. By thinking outside the box, you might find sustainable solutions that don’t hinge solely on the usual tax hikes.

How Might UBI Affect Long-Term Economic Growth?

You might wonder how UBI impacts long-term growth. It can boost consumption and reduce poverty, encouraging entrepreneurship and innovation. However, it may also decrease labor supply and savings, leading to lower capital investment and slower technological progress over time. The overall effect depends on how UBI is financed and designed. If you focus on balancing incentives and investments, UBI could support sustainable growth, but poorly managed, it might hinder economic expansion.

Can Regional Cost Variations Be Effectively Incorporated Into UBI Design?

Did you know housing costs can vary by over 90% across regions? When considering regional cost variations in UBI, you realize that tailoring payments helps address local needs more effectively. You’d need accurate data and smart systems to adjust payments accordingly, but doing so could reduce poverty and promote regional growth. By incorporating regional differences, you guarantee UBI truly supports people where they need it most, making it fairer and more impactful.

What Are the Political Barriers to Adopting UBI at Scale?

You should recognize that political barriers hinder UBI’s large-scale adoption. Deep ideological divides create opposition, especially from conservatives fearing dependency and welfare disruption. Public skepticism, fueled by concerns over affordability and work disincentives, influences policymakers. Additionally, electoral politics and fear of backlash make leaders hesitant. Overcoming these barriers requires building bipartisan support, clarifying misconceptions, and demonstrating UBI’s potential to address economic insecurity across diverse communities.

Conclusion

Like Icarus soaring too close to the sun, we often see UBI as an unattainable dream, fearing it’ll bring us crashing down. But what if we reframe our perspective, recognizing that with careful planning and innovation, it’s within our reach? Don’t let fear hold you captive as the sirens of doubt sing. Instead, challenge the narrative, and remember—sometimes, the greatest leaps require believing in the wings we forge ourselves.